Phasing out Russian Nuclear Fuel and Technologies from European market: How the EU is going to strike Rosatom

Russia’s military aggression against Ukraine in 2022 became one of the key catalysts for initiating the diversification of nuclear fuel supplies away from Russia to the EU, as well as a trigger for downsizing further cooperation with Russian Federation within the nuclear sector. Currently, Europe is implementing projects to build up and commission new Western-style reactors and promoting prototypes of Small Modular Reactors (SMR). Jointly, all these efforts expected to ensure the EU’s energy security and self-reliance from Russian nuclear technologies in the near future.

The EU, the USA, and Ukraine: Joint Heading To Energy Security in the Nuclear Sector

As the EU prepares to approve its 17th package of sanctions against Russia — expected by May 20 — the European Commission has publically communicated a Roadmap towards ending Russian energy imports, providing a stepwise action plan for gradually eliminating addiction on Russia’s nuclear industry, specifically any business cooperation with the state atomic energy corporation Rosatom.

These restrictive measures mark a precedent, as this is the first time sanctions against Russia’s nuclear sector have been introduced at the international level — unlike if it previously imposed but at the national level mostly.

Early 2023, Ukraine imposed 50-year sanctions on Rosatom and its subsidiaries. On February 5, 2023, the President of Ukraine enacted the National Security and Defense Council’s Decision “On the Application and Amendment of Personal Special Economic and Other Restrictive Measures (Sanctions),” which introduced restrictions against Russia’s nuclear sector.

In 2024, the United States passed as well the Act to gradually reduce and eventually ban imports of Russian uranium. The “Prohibiting Russian Uranium Imports Act” (H.R.1042) was signed by President Joe Biden on May 13, 2024. This move stands as one of the strongest unilateral initiatives and an example of abandoning ongoing cooperation with the Russian nuclear sector following the full-scale invasion of Ukraine.

The European Commission’s Action Plan to Phase Out Russian Energy Imports, Including Nuclear

On May 6, 2025, the European Commission has published the Roadmap towards ending Russian energy imports (COM(2025) 440 final). It covers energy sources such as natural gas, oil, enriched uranium, and other materials or services essential for the operation of EU nuclear power plants.

The Roadmap was developed to implement the REPowerEU plan (SWD(2022) 230 final), adopted in 2022 as the EU’s response to Russia’s full-scale war against Ukraine.

“…With REPowerEU, we have diversified our energy supply and drastically reduced Europe’s former dependency on Russian fossil fuels. It is now time for Europe to completely cut off its energy ties with an unreliable supplier. And energy that comes to our continent should not pay for a war of aggression against Ukraine. We owe this to our citizens, to our companies and to our brave Ukrainian friends,” — stated the European Commission President Ursula von der Leyen regarding the Roadmap’s adoption.

Measures already in place since 2022 have significantly reduced EU countries’ addiction to Russian energy sources. However, by the end of 2024, the EU still imported 52 billion cubic meters of Russian gas, 13 million tons of oil, and over 2 800 tons of enriched uranium, utilized notably in the production of nuclear fuel.

Impact of Russian imports of nuclear technologies for the EU

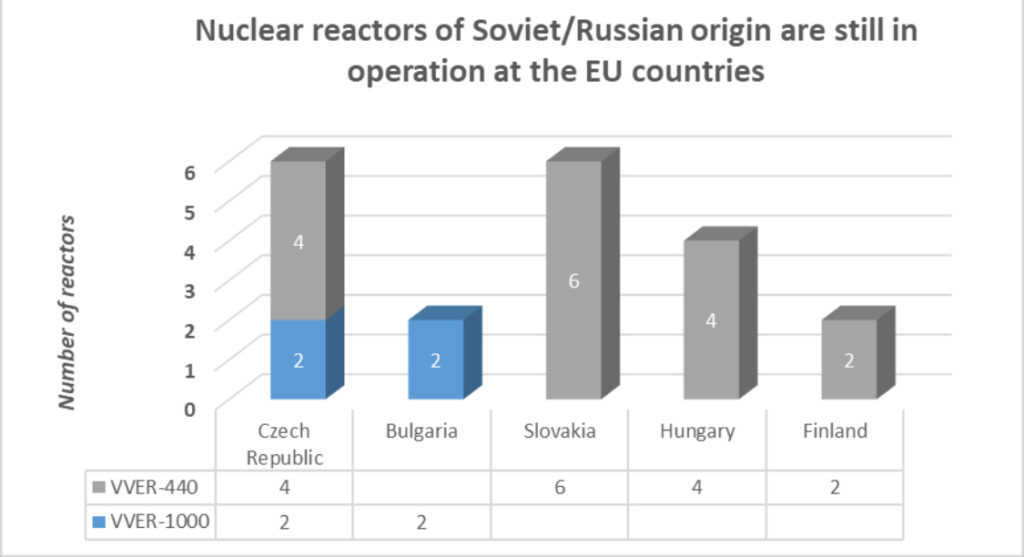

Russia exports products and provides services to the EU customers at all stages of the nuclear fuel cycle. This dependency is most pronounced in five EU member states — Bulgaria, Slovakia, Hungary, the Czech Republic, and Finland — all these countries operate Soviet/Russian-designed VVER-type (Water-Water Power) reactors and use Russian nuclear fuel supplied by the TVEL Fuel Company (TVEL).

Nuclear reactors of Soviet/Russian origin are still in operation at the EU countries

Picture 1

The EU countries also rely on Russia in the sphere of nuclear raw and processed materials, spare parts, and fuel cycle services supply. Additionally, Russia plays a major role in delivering of radioisotopes for medical use, particularly for cancer treatment.

The EU also heavily depends on uranium imports from Russia. Over 85% of the world’s uranium consuming capacity is mainly mined in six countries: Kazakhstan, Canada, Australia, Namibia, Niger, and Russia.

One challenge in diversifying nuclear imports lies in the high market concentration of conversion and enrichment services, which are essential for turning uranium concentrate into nuclear fuel.

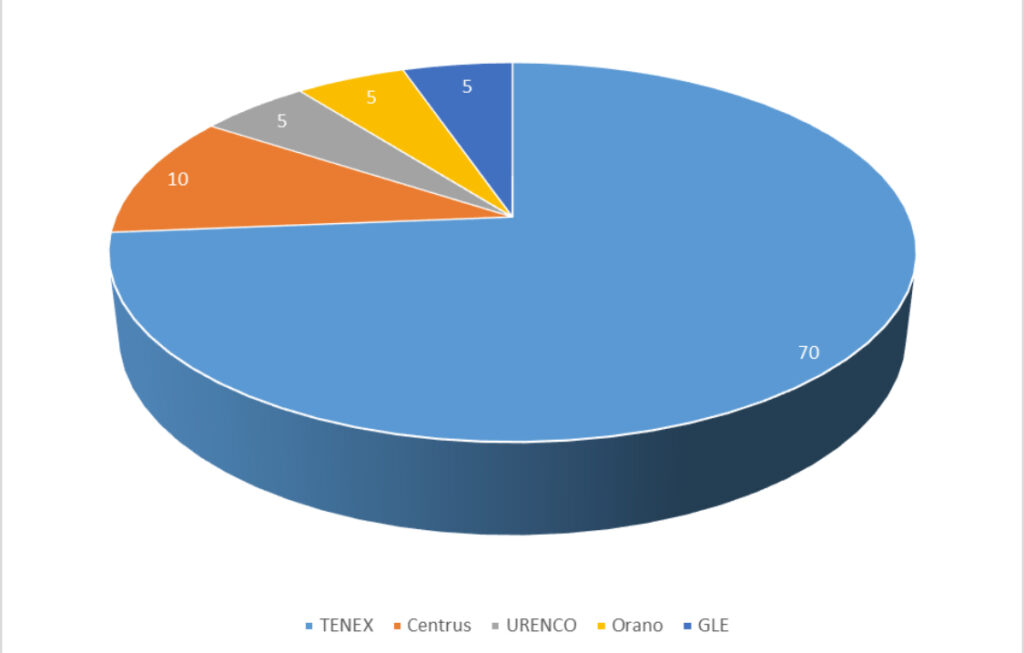

As of late 2022, the leading players in the HALEU (High-Assay Low-Enriched Uranium) market were (see also Picture 2):

- TENEX (Russia) ~ 70-80%. With commercial-scale HALEU production, but Western sanctions are reducing its future role.

- Centrus Energy Corp. (USA) ~ 10-15%/ The only operational HALEU production in the U.S. scaling up slowly with DOE support.

- URENCO consortium (UK, Netherlands, Germany) <5%/ Plans to enter the market via its U.S. facility in New Mexico, not yet operational.

- China National Nuclear Corporation (is an emerging but not yet dominant player in the global market. Domestic only for now)

- Orano (France) <5%/ Exploring HALEU production, but no active capacity in 2025.

- Global Laser Enrichment, GLE (USA) <5% (R&D stage). No commercial production yet; laser enrichment technology under development.

Market share of global HALEU suppliers, %

Picture 2

Hence the situation is sophisticated, however not hopeless. For passing out of Russian domination, the EU countries need to diversify their sources and invest heavily in domestic production capacity.

However, Western companies currently lack sufficient capacity to meet EU demand. In 2024, 23% of the EU’s uranium conversion needs and 25% of enrichment services were still covered by Russian suppliers.

European firms have announced plans to expand enrichment capacities, but results are expected no sooner than by 2027. Globally, the uranium conversion industry faces hurdles due to technological challenges and market uncertainty.

EU nuclear operators also still rely on Russia for supply of spare parts and provision of technical services for nuclear plants still in operation.

New Restrictions to Gradually Ending of Russian Nuclear Imports

In recent years, EU member states have actively worked to replace Russian nuclear fuel for VVER-type reactors with alternative suppliers. As part of this strategy, the EU is financially supporting Westinghouse (APIS project) and Framatome (SAVE project), each receiving €10M Euro as per the Euratom Research and Training Program.

This initiative is already yielding results: in 2024, the first test fuel assemblies were loaded into reactors in Bulgaria and Finland. Ukraine serves as a leading example, having successfully switched all VVER-type reactors to the fuel of Westinghouse production.

The EU’s move away from Russian nuclear fuel is both a strategic choice and a compelled response to new geopolitical threats. Early results of this policy are already visible and have been strengthened by the European Commission’s new sanctions, aimed at gradually eliminating dependence on the Russian nuclear sector.

The adopted Roadmap outlines several key mechanisms:

Trade restrictions:

- Economic measures to reduce the attractiveness of importing enriched uranium from Russia and encourage the development of EU-based producers.

Contract restrictions:

- A ban on new contracts for Russian uranium, enriched uranium, and other nuclear materials via the Euratom Supply Agency.

- Existing contracts may continue, but extensions will not be allowed.

The European Commission is also requiring member states to develop national diversification plans, with specific actions and deadlines to phase out Russian nuclear imports. The first drafts are expected by end of 2025.

Strategic Implications

The EU’s Roadmap to end imports of Russian energy — including nuclear fuel — is a clear sign that Europe recognizes the security, economic, and political risks of energy dependence on Russia.

It’s not a secret that through nuclear fuel supply and nuclear plant construction projects in strategic regions such as Europe and Middle Asia, Russia strengthens its presence and deepens economic and political dependencies.

The upcoming 17th sanctions package is expected to include measures targeting Rosatom’s operations within the EU. The recently published Roadmap is likely the first step and a testing ground for the EU’s sanctions strategy in the nuclear sphere.

While the shift toward energy independence is crucial, the full impact of these measures will become evident only over time. Displacing Russia from the global nuclear market will require consistent and long-term efforts from all stakeholders.

It’s also important to note that the governments of some EU states — such as Hungary and Slovakia — which regularly oppose stronger energy sanctions against Russia, remain direct beneficiaries of Russian nuclear goods and services. This reality casts some doubt on the EU’s unified stance toward banning Russian nuclear imports, though the political will of most EU nations is strong, and a compromise is likely (see also Picture 1).